Offers battle to shake off bearish disposition as U.S. tech goliaths fall again

TOKYO (Reuters) - Asian offers battled to stem a bearish state of mind on Friday after U.S. huge tech firm offers fell again for the time being on developing questions about U.S. boost and stresses over their extended valuations.

|

| Document PHOTO: A man utilizing his cell phone is outlined against a stock citation board outside a business firm in Tokyo February 21, 2006. REUTERS/Toru Hanai |

MSCI's broadest list of Asia-Pacific offers outside Japan .MIAPJ0000PUS plunged 0.2%, floating simply over a one-month trough contacted recently. Japan's Nikkei .N225 rose 0.3%.

Souring the mind-set, the U.S. Senate on Thursday killed a Republican bill that would have given around $300 billion in new Covid help, as Democrats looking for unmistakably additionally subsidizing kept it from progressing.

"The requirement for more financial help appears glaringly evident, yet the odds of up and coming help have reduced altogether," composed Rodrigo Catril, senior FX tactician at National Australia Bank in Sydney.

Information additionally demonstrated the quantity of Americans recording new cases for joblessness benefits stayed high a week ago, and the all out number of individuals who are on joblessness benefits expanded to 29.6 million.

Political and military strains among Washington and Beijing seemed to escalate as Taiwan upbraided China on Thursday over enormous scope air and maritime drills off its southwestern coast.

U.S. tech shares, verifiable pioneers of the world's stock recuperation since late March, neglected to support a concise bounce back.

On Wall Street on Thursday, the S&P 500 .SPX lost 1.77% while the Nasdaq Composite .IXIC dropped 1.99%, both on course for a second consecutive seven day stretch of losses.[.N]

The NYSE Fang+ file of enormous 10 tech organizations .NYFANG has lost 5.4% so far this week - its greatest week after week misfortune since the market disturbance in March whenever continued before the finish of Friday.

In any case, the list is more than twofold its March trough and financial specialists have assembled that their high valuations are legitimate considering close to zero loan fees in a great part of the created world and huge liquidity the world's national banks have made.

Numerous speculators have said the selloff was a solid adjustment.

However, with the world's stocks despite everything exchanging close to the most costly levels comparative with benefit viewpoint since the 2000 tech bubble, a few experts called for alert.

"Worldwide offers had mobilized on desires for financial recuperation from lockdowns. Yet, as the pre-winter starts (in the northern half of the globe), individuals wonder if the Covid contaminations could exacerbate," said Kozo Koide, boss market analyst at Asset Management One.

"You can't be sure whether antibody organization is that simple nor if banks need to aside more arrangements for battling firms in cordiality part. Thinking about every one of that, speculators are probably going to scrutinize the current valuations can be defended," he said.

In the money market, the British pound wobbled almost a 1/2-month low set on Thursday on fears that UK-EU exchange dealings may self-destruct.

Ad

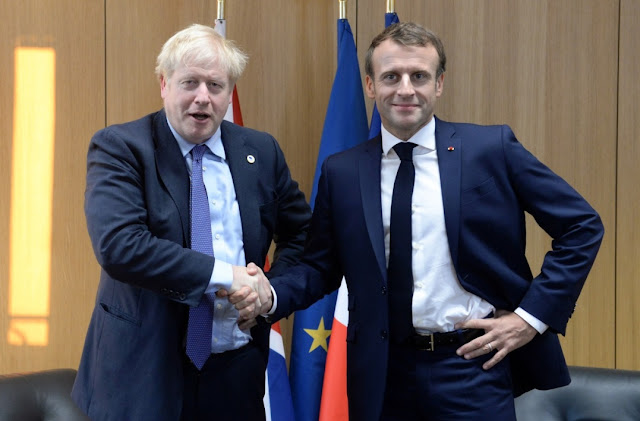

The European Union disclosed to Britain it ought to desperately scrap an arrangement to break their separation deal, yet Prime Minister Boris Johnson's legislature won't and squeezed ahead with a draft law that could sink four years of Brexit talks.

The pound exchanged at $1.2815 GBP=D4, having slipped to $1.2773 overnight.

The euro changed hands at $1.1833 EUR= having quickly hit a one-week high on Thursday after European Central Bank President Christine Lagarde said that while the ECB is watching the conversion standard, it's anything but a money related arrangement device.

Brokers interpreted her remarks as meaning the ECB was probably not going to attempt measures to debilitate the cash.

The yen was minimal moved at 106.18 per dollar JPY=.

Oil costs were feeling the squeeze from an unexpected ascent in U.S. reserves and powerless interest due to the Covid pandemic.

Brent rough LCOc was down 0.2% at $39.98 a barrel in the wake of falling about 2% on Thursday. U.S. unrefined CLc1 was level at $37.30, having fallen 2% in the past meeting.

Comments

Post a Comment